The behavioral health industry is coming off a record number of transactions and as multiples remain high, companies are having to get smarter about growth with so much competition for best-in-class providers.

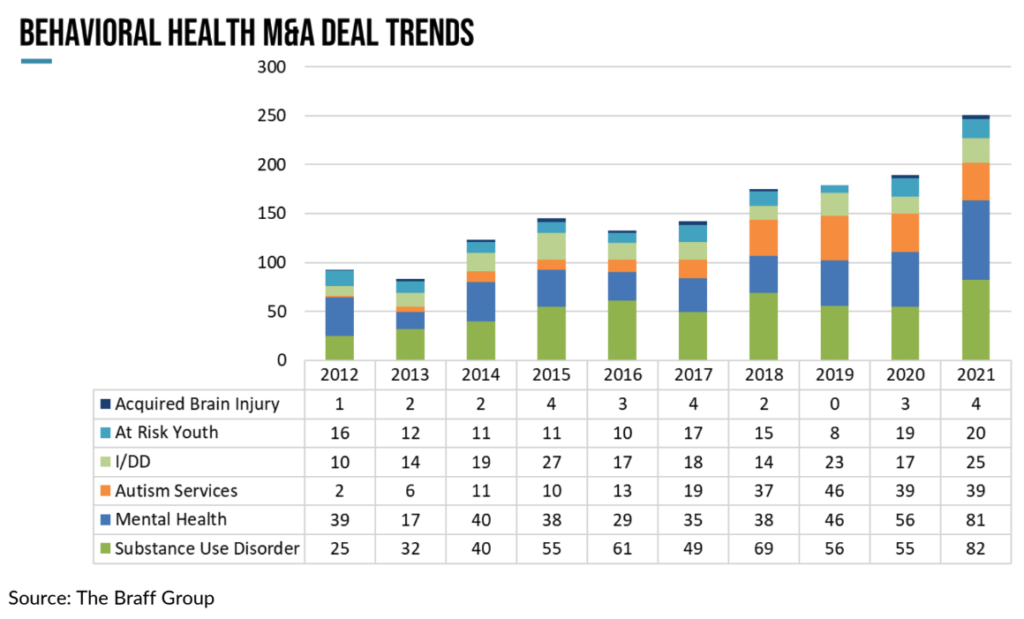

Proprietary data from the M&A firm The Braff Group shows that the behavioral health industry saw 251 deals completed in the space, up about 33% from 2020.

Dexter Braff, president of The Braff Group, said that over the last five years behavioral health has seen more deals and a faster rate of growth than any of the other segments of health care that the firm tracks. This includes home health and hospice, home medical equipment, health care staffing and pharmacy services.

Within the behavioral health space, the mental health segment and the substance use disorder (SUD) treatment segments have driven much of the growth. The mental health segment saw 81 deals while the SUD space saw 82 deals during 2021.

Over the last five years, the SUD segment has seen the most deals but the rate of growth is still second to the mental health segment, Braff said during a Behavioral Health Business 2022 Outlook Webinar.

However, dealmaking in the autism space has slowed since a big jump in transactions in 2018, according to data from Braff.

Kathleen Stengel, CEO of Voorhees, New Jersey-based behavioral health and neurology services provider NeurAbilities Healthcare, said during the webinar that some segments of the market lack large platform targets but other areas are ripe for growth.

“I think in certain areas, you’re going to see stagnant growth like with autism services,” Stengel said. “I think that that’s going to continue the way that it is.”

However, other areas like medication-assisted treatment and mental health are seeing increased demand.

“Legislation is funding a lot of these programs and it looks like it’s going to be sustained over time,” she added. “The demand is not going away and I see it growing exponentially over time.”

Braff agreed that there is a significant appetite for mental health providers.

“I think the most open market right now is the mental health space because it’s the newest one that people are tapping into,” he said.

Growth through de novo and small tuck-ins

Even with a lack of large-scale platforms available in the market, there are opportunities that could be done at a smaller scale. These largely include tuck-in deals to bolster or diversify a company’s service lines or expand into a new region.

Matt Pettit, the founding partner of Seven Hills Capital, said that his firm’s partner company Versicare Group has already completed a tuck-in acquisition in 2022 and three more deals in the letter of intent stage, all in the intellectual and developmental disability and Applied Behavioral Analysis spaces.

He also said that the capital deployment cycle for many funds and investment vehicles suggests continued investment and for funds to hold on to investments a little longer. The longer hold period could beget a new wage of “buy-and-build” tuck-ins within behavioral health, Pettit added.

Stengel said that high valuations and the regional focus of her business are leading her to look at acquiring small practices or going even deeper on de novo growth.

“I’m not looking for anything with a large presence,” Stengel said. “I want to stay in the region we want, so de novo is the name of our game.”

Multiples expected to hold strong in 2022

Braff said that services-based businesses, like the mental health segment, would normally sell for a valuation range of 4x to 6x of EBITDA, earnings before interest, taxes, depreciation and amortization.

“It doesn’t take a lot right now to get into the double-digits multiples of EBITDA If you have a company that’s growing quickly or is generating about $4 or $5 million worth of EBITDA,” Braff said.

For a decent operation, a behavioral health firm can start at 6x EBITDA but may range up to 13x or higher for very select assets.

An investor may be willing to buy at 10x to 12x multiples for initial investments but won’t likely continue at that high of a rate for other add-on deals lest they risk limiting their return on investment potentially limiting the swift growth of investment in behavioral health, Braff said.

Panelists cautioned that a major stumble in financial performance by large consolidators or high profile companies like Lifestance Health or Refresh Mental Health could slow down investment.

“That’ll send a big chill down the back of investors,” Braff said. “Those are the type of things that can have a very significant impact on valuation, mostly because it just gets people to stop in their tracks. And they go, ‘Wait, this was all great. But now I got a leader that if they stumbled and what does that mean for me?’”

Pettit said that large consolidators in the substance use disorder space ran into financial distress a few years ago but the impact was short-lived as investors eventually came back into the market due to market trends and those “issues” getting worked out.

At the end of the day, teams that are building high-quality companies with great fundamentals will always be in demand.

“The assets with the best teams and the best stories will find a way in an efficient market to meet managers who need to deploy capital,” said Pettit.

Companies featured in this article:

NeurAbilities Healthcare, Seven Hills Capital, The Braff Group