When it comes to behavioral health dealmaking, buyers and sellers can sometimes be ships passing in the night. There’s plenty of interest in getting a deal done early on, but it quickly fizzles out, with both parties going their separate ways.

Especially in 2022, buyers and sellers were frequently not on the same page in terms of valuing a business. Additionally, in some instances, transactions didn’t come together because of regulatory uncertainty or other unforeseen factors.

That could soon change, however, and 2023 could be the year of second chances, according to industry insiders. In weeks and months to come, buyers will likely look to scoop up behavioral health companies at a more reasonable rate, even by circling back to once-trashed transactions.

“It’s always important that we follow up and stay engaged, stay in touch with those folks,” Rush Brady, AVP of development at Odyssey Behavioral Health, said during a recent Behavioral Health Business webinar sponsored by The Braff Group. “Those opportunities [to acquire a perfect fit] are few and far between.”

Founded in 2015, behavioral health provider Odyssey Behavioral Health operates 12 residential treatment centers and 19 outpatient locations. As part of its service mix, it offers psychiatry, eating disorder treatment, outpatient services and more.

Revisiting past opportunities is important, as dealmaking competition is guaranteed to stay fierce for quite some time.

Its likely investor interest will continue into the next decade, as demand for services remains high and the behavioral health market further matures. In 2023, though, valuations are expected to come down to Earth somewhat, at least compared to 2021’s M&A frenzy and 2022’s steady action.

Again, that makes 2023 a good year for potential partners to re-engage in deals that didn’t make sense because valuations were too high initially.

“It’s our belief that our country has been pretty good at physical health for a while, but we’re in the midst of an awakening around behavioral health,” John Hennegan, founding partner of Shore Capital, said during the webinar. “While there may be some near-term choppiness, the next 10 to 20 years look incredibly rosy for behavioral health, and we think that’s what’s driving so much interest.”

Shore Capital is a Chicago- and Nashville-based private equity firm that has raised approximately $1.3 billion in capital for health care businesses since 2009. It has made several behavioral health deals, including BrightView and Behavioral Innovations.

“It’s hard to find many sectors of the economy that show the same tailwinds and growing acceptance as behavioral health,” Hennegan continued. “We just see declines in stigma and growing acceptance from the older generations, down to a younger generation that has grown up in an environment where behavioral health is something they’re comfortable talking about and utilizing the services.”

Market snapshot

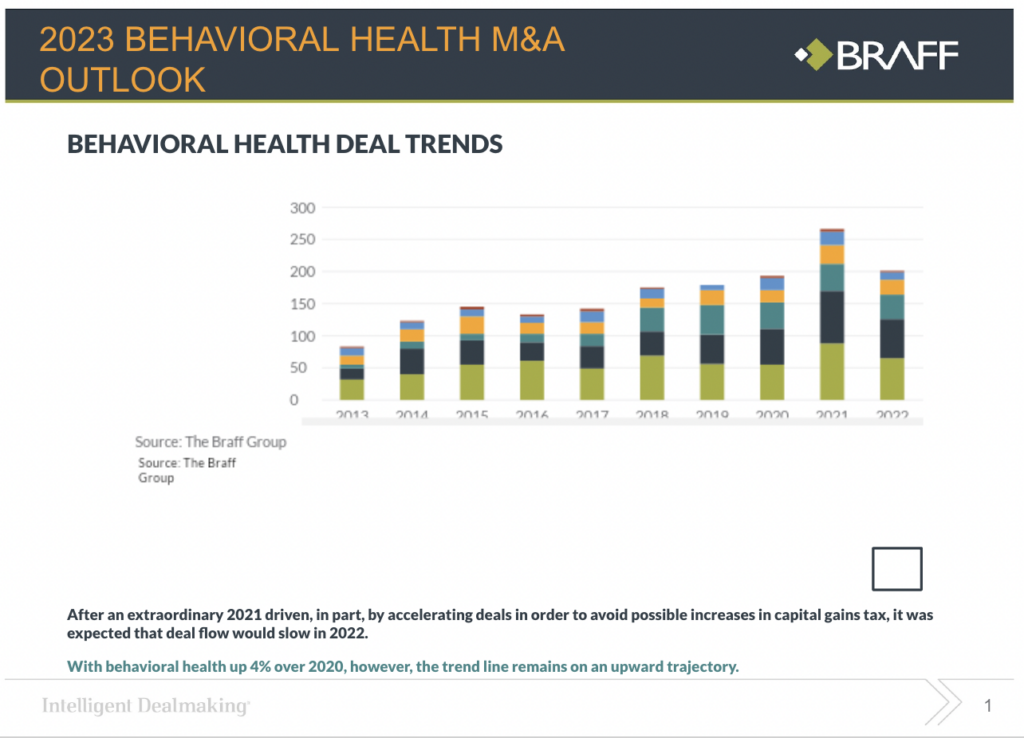

Last year, the behavioral health market cooled compared to 2021. But it was still the second-best year for behavioral health deals ever.

In 2022, there were 201 deals in the behavioral health sector, according to new data from The Braff Group. While that’s down from 2021’s staggering 256 deals, it’s up by 4% compared to 2020.

The Braff Group is a Pittsburgh, Pennsylvania-based mergers and acquisitions firm specializing in health care services. The firm has closed more than 375 transactions since it was founded in 1998.

And behavioral health remains one of the hottest, if not the hottest, areas of investment across health care.

“It is, by far, the most active segment now,” Dexter Braff, the president of the Braff Group, said during the Webinar.

Within the broader behavioral health category, mental health and substance use disorders were the most active areas last year, with 61 and 65 deals, respectively. Autism transaction volume, meanwhile, saw a dip between 2021 and 2020.

Overall, behavioral health deals have been trending up over the last decade.

“We’re clearly still focused on mental health and substance use disorder,” Braff said. “Within the substance use disorder [space], we’re much more focused on medication-assisted treatment and the lower-cost providers. We’re always looking for in-network companies.”

Declining valuations

Although the behavioral health deal market remains hot, the price of deals may drop amid larger macroeconomic headwinds.

“I think a lot of those lenders are retreating to positions or terms that are more comfortable to them,” Hennegan said. “That conservatism from the lenders necessitates conservatism from the investors as well, in the same way that if you’re going to buy a house and the mortgage is a 2% interest rate versus a 10% interest rate, you can’t pay the same amount for that house. You’re going to have to pay less as the cost of debt goes higher.”

In 2021 and the beginning of 2022, deals were at an all-time high. Prior to 2021, a provider could expect to sell at 4 to 6 times their EBITDA, Braff said.

“So when you see valuations above [6 times EBITDA], you’re in a premium area. Going into 2021, I would say that 10 times was pretty close to a starting point for valuations. I don’t think that that’s the case today, but it doesn’t mean you can’t necessarily get that in a competitive process if somebody needs a particular asset. But those kinds of starting points have gone down.”

That high starting point meant that many deals didn’t make sense from a buyer’s perspective.

With valuations coming down, potential partners are already beginning to re-engage in M&A discussions.

“We’ve seen a couple of processes that we participated in last year, or maybe sellers we’ve had conversations with, who we couldn’t quite get there [with], and they’re coming back around and re-engaging with us,” Brady said. “So we see that as maybe valuations settling a little bit, or, at least, it’s a reset of expectations to a degree. And so I think that will create additional opportunities for us in 2023 to be opportunistic in that environment.”

As an operator, smaller deals are a good opportunity for growth.

“We’ve grown significantly through tuck-in acquisitions since we were founded – on average, about one or two per year,” Brady said. “More recently, we’ve pivoted heavily towards organic growth.”

Additionally, money isn’t everything in a deal; finding the right match is also important. A seller might discover that their “backup buyers” fit the company better.

Hennegan gave the example of one of The Shore Group’s early investments in a provider called Brightview. Shore was excited by the provider’s approach to behavioral health care and its consolidated model, but the provider initially told them they went with another company.

“I was crestfallen when they chose a different group, but tried to affirm that our behavioral health expertise was going to be the best partner for them. [When] they got down the road with another party and realized that group hadn’t done anything in behavioral before and didn’t understand the nuance of their business, they were more inclined to be receptive to a phone call,” Hennegan said. “We had to wait out an exclusivity period, but when that ended, they called back, and we jumped right back in together.”

Braff noted that in his experience, backup buyers do at least 10% to 15% of deals. He advises companies to know not only who their No. 1 buyer is, but also who their No. 2 buyer is.

“Going back to the second buyer is crucial, which is why it’s so important that parties do their very, very best to always be respectful … because you might get another shot at it – either from the buy side or the sell side,” Braff said.

Companies featured in this article:

Odyssey Behavioral Healthcare, Shore Capital Partners, The Braff Group