Sabra Health Care REIT Inc. (Nasdaq: SBRA) is looking to expand its operator partnerships in behavioral health, especially in the addiction treatment space.

Leaders of the Irvine, California-based real estate investment trust (REIT) said on a Tuesday third-quarter earnings call that behavioral health was a major investment sector for Sabra, right behind senior housing.

“We continue to meet with new operators and explore business relationships within the addiction recovery sector, as well as other areas of behavioral health, where we see investment opportunities,” Talya Nevo-Hacohen, Sabra Health Care chief investment officer, said on the call.

Sabra Health Care’s portfolio largely consists of skilled nursing facilities and senior living assets. Last quarter, company leaders said Sabra’s behavioral health investments were meant to stabilize facility rent revenue and tap the growing demand for behavioral health services.

CEO Rick Matros echoed Nevo-Hacohen’s sentiments, noting that he likewise expects more investment opportunities in behavioral health in the future. He also said that future investment will be funded by “capital recycling,” or using the proceeds from the sales of other facilities.

Sabra Health Care’s behavioral health investments will eventually total $811 million once it completes the conversion of five facilities it owns to behavioral health uses.

In the first nine months of the year, Sabra Health Care has acquired one new behavioral health facility, according to its third-quarter financial filing. At the end of the third quarter, it had invested $756 million into a portfolio of 16 properties and two mortgages.

Sabra Health Care previously struck deals with substance use disorder (SUD) operators Landmark Recovery in 2019 and Recovery Centers of America in 2021.

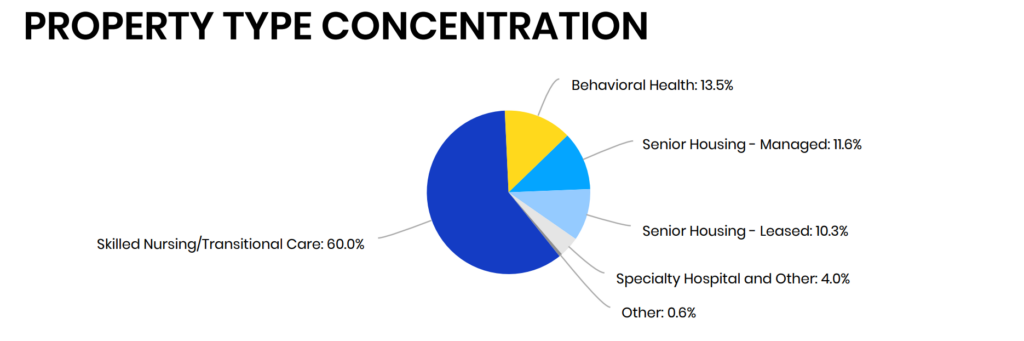

Behavioral health facilities are the second largest asset class, at 13.5%, of Sabra Health Care’s portfolio. It is second only to Sabra’s skilled nursing and transitional care portfolio. The latter represents 60% of its assets.

Corona, California-based Signature Healthcare Services and King of Prussia, Pennsylvania-based Recovery Centers of America are the fourth and fifth, respectively, largest single sources of annualized cash net of income (NOI) for Sabra Health Care, according to a company investor presentation.

Signature Healthcare Services accounts for 7% while Recovery Centers of America accounts for 5.3% of annualized cash NOI.

During the third quarter, one unnamed behavioral health operator reported limited occupancy due to struggles in finding enough staff, Nevo-Hacohen said. This is a prominent problem with even the largest behavioral health operators.

Behavioral health facilities may be better equipped to deal with workforce issues than other Sabra Health Care facilities, Matros said, referring to how staffing challenges can limit occupancy.

“Even though labor issues can affect all the asset classes to one extent or another … the breakeven point is much lower from an occupancy perspective [for the behavioral facilities] than it is for skilled nursing and senior housing,” Matros said.

Overall, Sabra’s portfolio of 16 behavioral health facilities totals 965 beds, with an occupancy rate of 83.1%.

Sabra Health Care’s revenue rose 9.5% to $140.8 million in Q3 2022. It posted a net loss of $50.1 million, $0.22 per share, compared to a net income of $10.2 million last year.

Health care REITs largely have been absent from behavioral health. Industry fragmentation, regulatory uncertainty and operational immaturity have kept them away. But in recent years, Sabra Health Care and others have made moves.

Birmingham, Alabama-based Medical Properties Trust Inc (NYSE: MPW) acquired Springstone for $950 million in 2021. The company then sold Springstone’s management group to Brentwood, Tennessee-based LifePoint Health for $250 million and retained Springstone’s real estate.

CareTrust REIT Inc (Nasdaq: CTRE), another senior care-focused REIT, also secured a facility conversion deal with Landmark Recovery.